CMSD

0.0900

Most stock markets gained Thursday even as President Donald Trump's new tariffs on dozens of countries took effect, with investors eyeing exemptions from his threatened 100-percent levy on semiconductors.

Sentiment was also lifted by hopes of easing geopolitical tensions after the Kremlin said Trump and Russia's leader Vladimir Putin were set to meet for talks in the coming days.

Paris and Frankfurt each piled on around one percent in midday deals.

London was a rare faller ahead of an expected interest-rate cut by the Bank of England.

"Trump's global web of tariffs is now in place, but the stock market appears largely unfazed," said Jochen Stanzl, chief market analyst at CMC Markets.

He added that buying was driven by "the potential for an interest rate cut by the Federal Reserve in just over a month and a possible meeting between Trump, (Ukraine leader Volodymyr) Zelensky, and Putin as early as next week".

The dollar struggled as the United States began charging higher tariffs on goods from dozens of trading partners, including the European Union and India, as part of Trump's drive to reshape global trade in America's favour.

Switzerland's stock market gained around one percent even after top officials failed to convince Washington not to impose a 39-percent tariff on Swiss goods.

Shortly before the new levies kicked in, Washington separately announced it would double Indian tariffs to 50 percent.

- Chip levies -

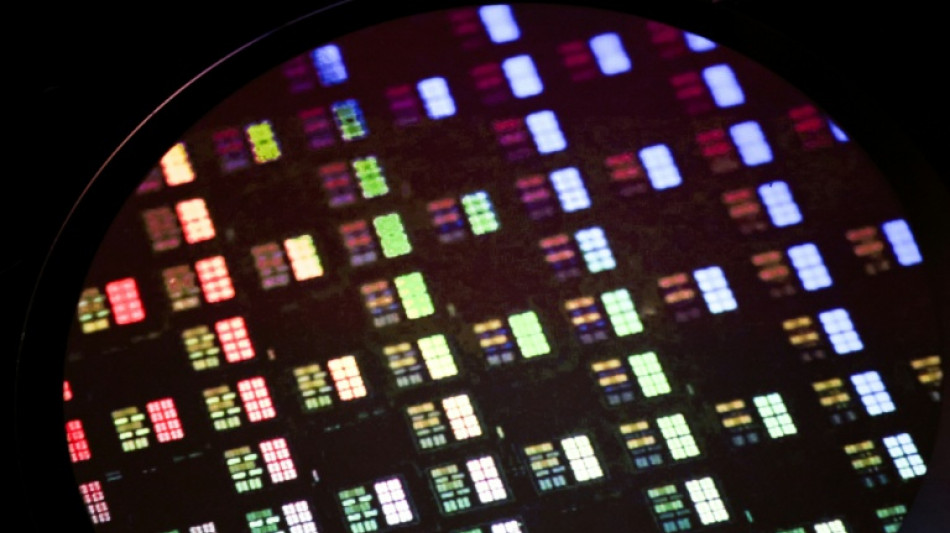

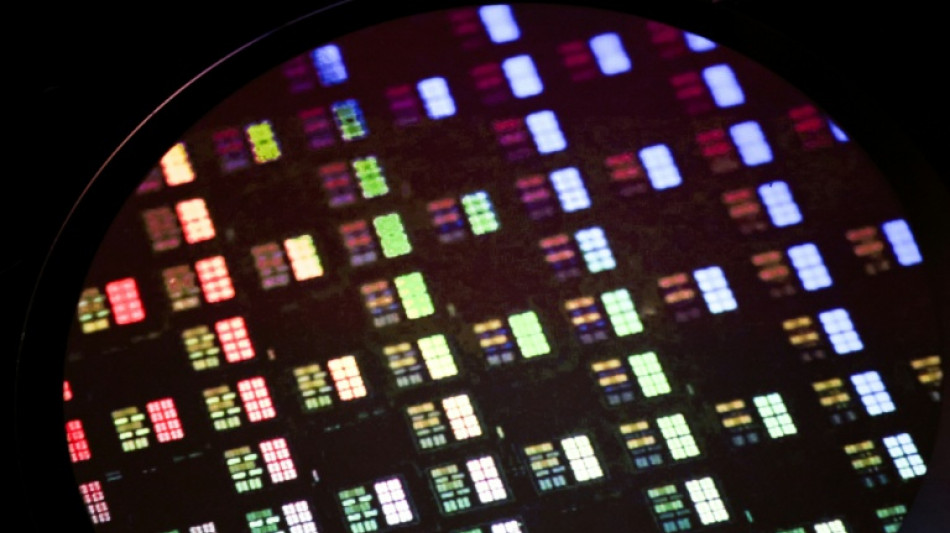

Asian markets extended gains following a strong day on Wall Street, with tech stocks lifted by chip-tariff exemptions for companies investing heavily in the United States or committed to do so.

Apple-linked stocks rose after the US tech giant pledged to invest an additional $100 billion in the United States.

Tokyo and Hong Kong closed in the green Thursday, with Taipei leading the way thanks to the surge in Taiwanese chip-making giant TSMC.

TSMC climbed five percent as Taipei said it would be exempt from Trump's threatened levies on the sector.

Seoul-listed Samsung, which is also pumping billions into the world's number one economy, rose more than two percent while South Korean rival SK hynix was up more than one percent.

However, some other Asian manufacturers took a beating, including Japan's Tokyo Electron and chipmaker Renesas.

Analysts said that while the chip threat was steep, there was optimism the final level would be lower.

Shanghai closed higher after data showed stronger-than-expected Chinese exports, with a surge in shipments to the EU and Southeast Asian nations offsetting a plunge in those to the United States.

Markets were already buoyed this week by bets on a Federal Reserve rate cute following weak US jobs data that signalled the economy was weakening.

Oil prices rose after Trump threatened penalties on other countries that "directly or indirectly" import Russian oil, after imposing his extra toll on India.

In other company news, shares in Sony jumped more than four percent after the PlayStation-maker raised its annual profit forecasts, citing strong performance in its key gaming business and a smaller-than-expected negative impact of US tariffs.

- Key figures at around 1030 GMT -

London - FTSE 100: DOWN 0.5 percent at 9,121.10 points

Paris - CAC 40: UP 1.1 percent at 7,719.07

Frankfurt - DAX: UP 1.4 percent at 24,266.65

Tokyo - Nikkei 225: UP 0.7 percent at 41,059.15 (close)

Hong Kong - Hang Seng Index: UP 0.7 percent at 25,081.63 (close)

Shanghai - Composite: UP 0.2 percent at 3,639.67 (close)

New York - Dow: UP 0.2 percent at 44,193.12 (close)

Euro/dollar: UP at $1.1667 from $1.1659 on Wednesday

Pound/dollar: UP at $1.3366 from $1.3358

Dollar/yen: DOWN at 147.36 yen from 147.38 yen

Euro/pound: UP at 87.28 pence from 87.23 pence

Brent North Sea Crude: UP 0.6 percent at $67.29 per barrel

West Texas Intermediate: UP 0.6 percent at $64.74 per barrel

H.Ng--ThChM