CMSD

0.0505

Oil prices rose and stock markets diverged Wednesday as investors tracked the Israel-Iran conflict and a looming US interest rate decision.

Wall Street's main indices were mixed in early deals after the open as investors awaited the Federal Reserve rate decision and weighed the latest news from Iran.

Despite rising tensions after President Donald Trump called for Iran's surrender, "there has been no sense of panic from investors", said David Morrison, market analyst at financial services firm Trade Nation.

"As far as the US is concerned, events are taking place a long way from home," he said.

"But there's also a feeling that investors are betting on a short and sharp engagement, resulting in a more stable position across the Middle East than the one that currently exists."

In Europe, the London stock market rose but Paris and Frankfurt were down in afternoon deals after Asian equities closed in different directions.

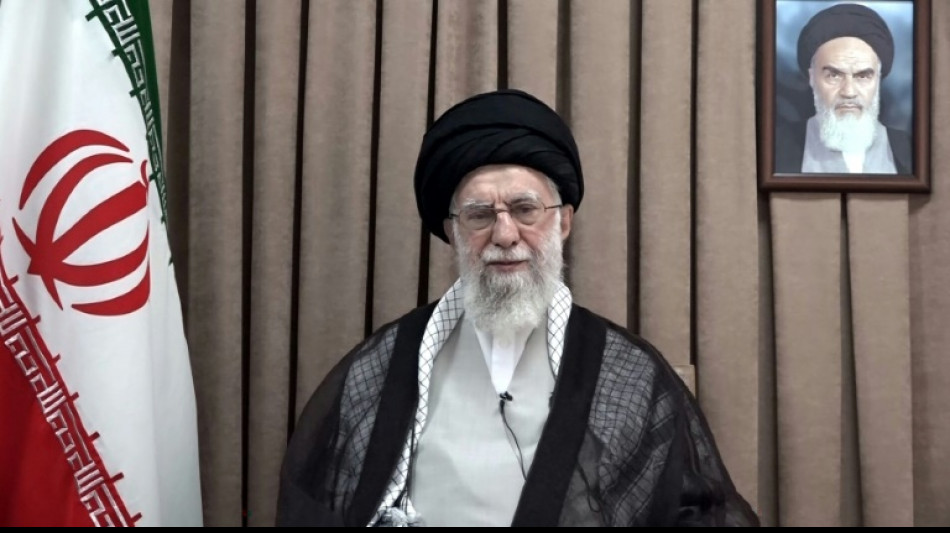

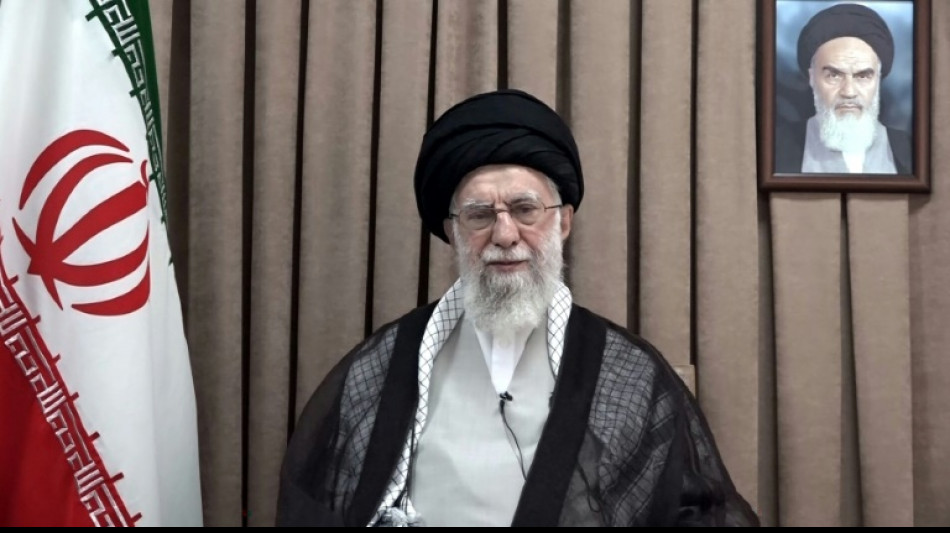

Oil prices rose after surging the previous day as Iran's supreme leader Ayatollah Ali Khamenei rejected Trump's call for an "unconditional surrender".

Six days into the conflict, Khamenei warned the United States would face "irreparable damage" if it intervenes in support of Israel.

Gas prices rose with concerns surrounding its supply.

Of particular concern is the possibility of Iran shutting off the Strait of Hormuz, through which around one fifth of global oil supply is transported.

"Global market direction remains clouded by tariffs, complicated by the Middle Eastern conflict and confounded by the lack of any obvious positive catalysts," said Richard Hunter, head of markets at Interactive Investor.

- Fed watch -

The Fed is widely expected to hold interest rates steady Wednesday, as officials gauge the impact of US tariffs on inflation.

The central bank has ignored calls from President Donald Trump to cut borrowing costs as the world's biggest economy faces pressure.

The US central bank will also release on Wednesday its rate and economic growth outlook for the rest of the year, which are expected to take account of Trump's tariff war.

Weak US retail sales and factory output data on Tuesday rekindled worries about the impact of tariffs on the economy but also provided hope that the Fed would still cut rates this year.

"The Fed would no doubt be cutting again by now if not for the uncertainty regarding tariffs and a recent escalation of tensions in the Middle East," said KPMG senior economist Benjamin Shoesmith.

In a busy week for monetary policy, Sweden's central bank cut its key interest rate on Wednesday to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 1335 GMT -

Brent North Sea Crude: UP 1.3 percent at $77.41 per barrel

West Texas Intermediate: UP 1.3 percent at $74.24 per barrel

New York - Dow: UP 0.1 percent at 42,244.64 points

New York - S&P 500: FLAT at 5,984.80

New York - Nasdaq Composite: DOWN 0.1 percent at 19,503.61

London - FTSE 100: UP 0.2 at 8,848.38

Paris - CAC 40: DOWN 0.4 percent at 7,649.90

Frankfurt - DAX: DOWN 0.7 percent at 23,283.31

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

New York - Dow: DOWN 0.7 percent at 42,215.80 (close)

Euro/dollar: UP at $1.1491 from $1.1488 on Tuesday

Pound/dollar: UP at $1.3437 from $1.3425

Dollar/yen: DOWN at 144.78 yen from 145.27 yen

Euro/pound: DOWN at 85.50 pence from 85.54 pence

burs-bcp-lth/rl

Y.Su--ThChM