RBGPF

0.1000

The Trump administration is in talks to take an equity stake in Lithium Americas, which would insert the government into another private enterprise in the latest challenge to American free-market traditions.

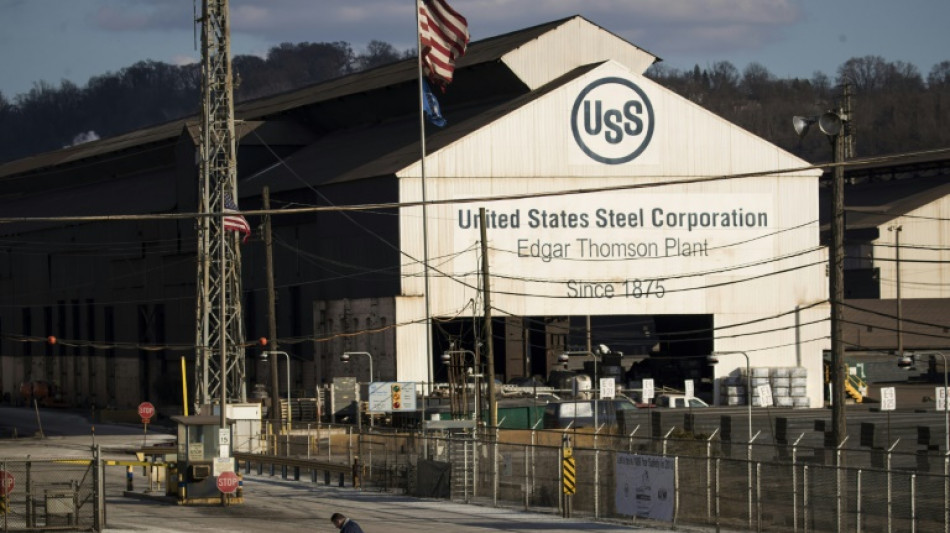

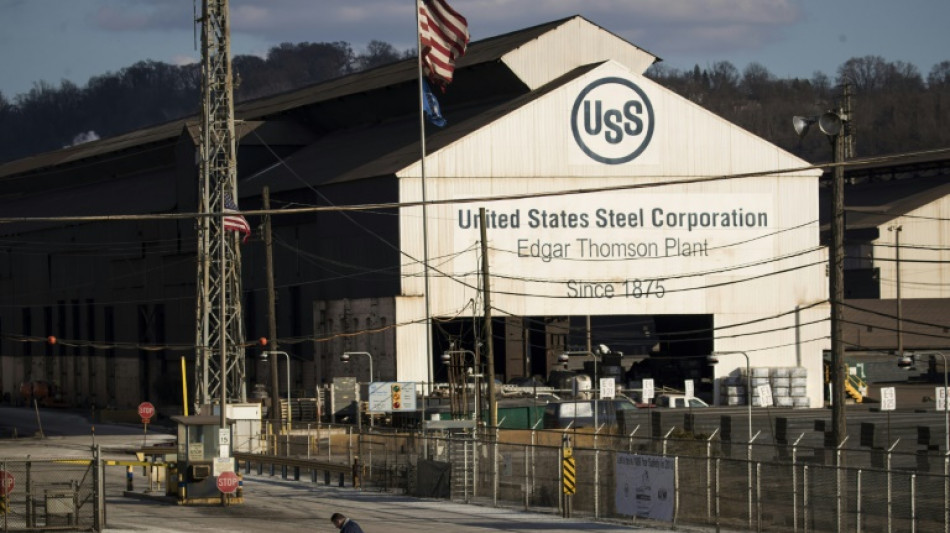

The move comes on the heels of Trump announcements establishing government holdings in struggling semiconductor giant Intel and the rare earth company MP Materials. Trump also secured a "golden share" for Washington in United States Steel as a condition of its sale to Japan's Nippon Steel.

Talks are still ongoing on the Lithium Americas stake, part of a renegotiation of a US Department of Energy loan held by the Canadian mining company and General Motors, said a Trump administration official.

The White House has characterized the stock holding arrangements as a boon for taxpayers that points to Trump's prowess as a dealmaker, while asserting that day-to-day management will be left to companies.

But free-market advocates have reacted with various degrees of alarm to a trend they see as undermining the strength of the US system and stoking crony capitalism. In the US system, the government sets up the rules governing the private sector but generally stays out of it thereafter as firms respond to market signals.

"It undermines competition," said Fred Ashton, director of competition policy at American Action Forum, who believes inserting the state into private enterprise leads to inefficiency and benefits politically favored firms over those less connected.

"We know the president likes to win so there's no way the government lets these firms fail," Ashton said.

Trump administration officials recently made use of the US Steel golden share. The company had planned to keep paying 800 workers while idling an Illinois factory, but decided to keep the plant running after Commerce Secretary Howard Lutnick invoked the golden share, according to a Wall Street Journal report.

"You need to let an executive of the company conclude the best use of the capital," said governance expert Charles Elson of the University of Delaware, who criticized the White House intervention.

"The government is not in the business of picking winners and losers in the capital system," he said. "That's why we have a capital system."

- Bipartisan consensus -

It is not unprecedented for the US government to hold equity stakes. In response to the 2008 financial crisis, the US government amassed holdings in insurer AIG, General Motors and fellow automaker Chrysler as a condition of government support packages.

But the Treasury Department sold off the shares after the crisis ended, reflecting a bipartisan consensus, according to Michael Strain of the American Enterprise Institute think tank, who said presidents from Ronald Reagan to Barack Obama embraced the free market.

"Obama would have laughed out of the room the suggestion that the government take an equity stake in a manufacturing company," Strain said in a recent column that also criticized the White House's tying of Nvidia and AMD export licenses to payments to the government.

Obama "understood that in America's system of democratic capitalism, the government does not own or shake down private companies," Strain said in the piece headlined "Is Trump a State Capitalist?"

Strain, in an interview, predicted a "massive amount of crony capitalism" under Trump compared with the norm, but said the shifts will be too limited to significantly tilt the US macroeconomy given its size and tradition.

Ashton said he agrees that US status as a free market economy is not seriously in question. But he believes Trump's conduct is distorting company behavior, noting reports that Apple may take a stake in Intel following Apple CEO Tim Cook's August White House visit when he presented Trump with a 24-carat gold piece.

"It's become so murky," Ashton said. "We don't know whether it's a business decision because it's a business decision or whether it's a business decision because they have to please the White House in some way."

L.Kwan--ThChM