RBGPF

0.1000

Artificial intelligence behemoth Nvidia on Wednesday said quarterly sales reached a higher than expected $30 billion in the last quarter, though that growth was slower than the furious pace seen in previous quarters.

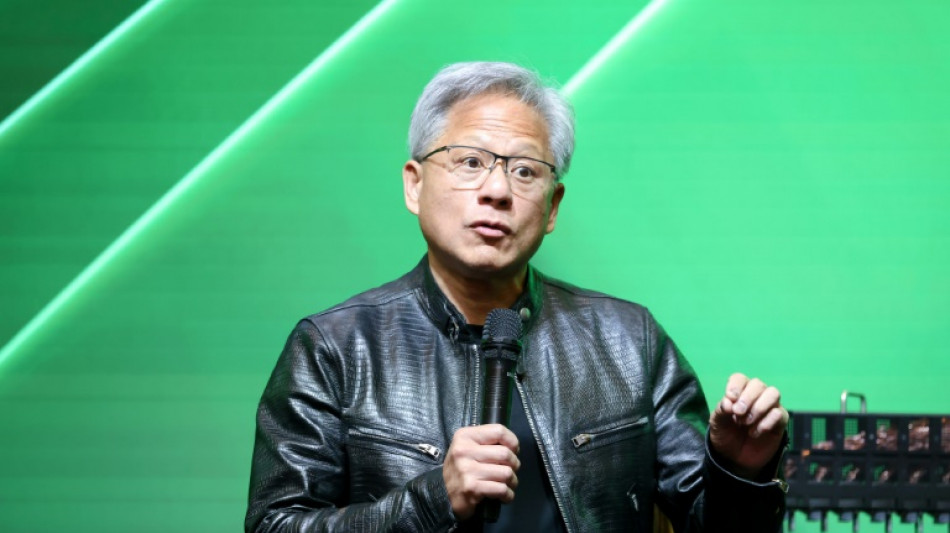

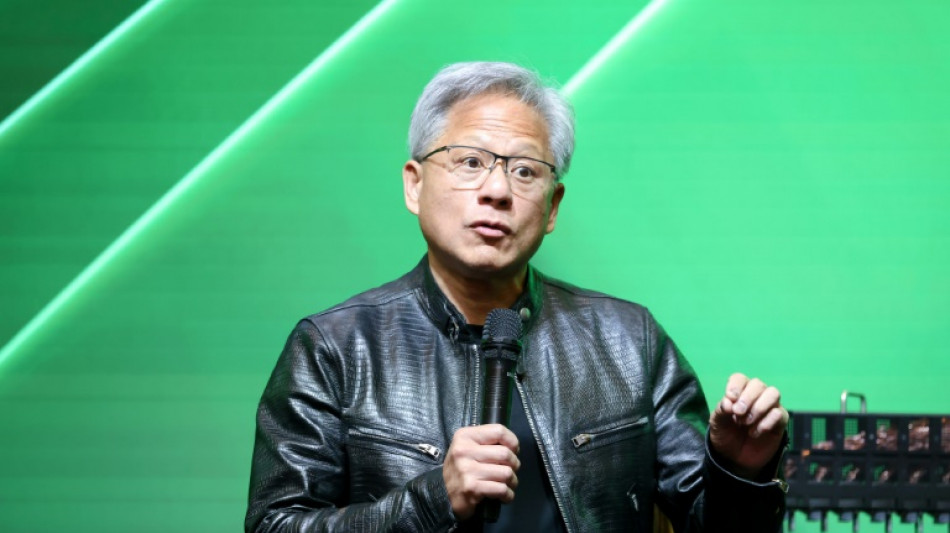

Declared by Wall Street to be the world's most important stock, the California-based AI chip-maker led by CEO Jensen Huang saw its share price fall by about four percent in after hours trading.

Even though sales and profit, which hit $16.5 billion in the period, more than doubled from a year earlier, investors showed nervousness that Nvidia's extraordinary growth, spurred by the AI frenzy, may be showing signs of normalization.

The world's biggest tech companies have invested tens of billions of dollars, quarter after quarter, into Nvidia's powerful AI chips and software in order to get their ChatGPT-style AI models up and running.

Microsoft, Google, Meta, Tesla and Amazon all depend on Nvidia technology to train generative AI models and execute the heavy computing workloads needed to deploy the new technology.

Ahead of the latest earnings, Nvidia's share price was up about 160 percent year-to-date and has accounted for a third of the broad-based S&P 500 index's gains this year.

Nvidia stock wavered in July, as investor sentiment hesitated over whether generative AI will be a money making enterprise anytime soon.

But in recent weeks Nvidia's share price has been back on its historic tear, nearing the heights of a few months ago when the firm was very briefly the world's most valuable company when measured by stock valuation.

The market had expected the company to post sales at about $28 billion, more than double from a year ago.

"Nvidia once again delivered spectacular results, beating expectations with margins that rival its previous blockbuster quarters, despite growing economic uncertainties and AI bubble concerns," said Emarketer technology analyst Jacob Bourne.

Nvidia's financial postings have become must-see events on Wall Street after the company has repeatedly crushed expectations, many times tripling its revenue and profit.

- 'Disappointed a touch' -

But some analysts worried that Nvidia was slowly coming down to earth with its latest earnings, as stellar as they might be.

"It's less about just beating estimates now -- markets expect them to be shattered, and it's the scale of the beat today that looks to have disappointed a touch," said Matt Britzman, senior equity analyst at Hargreaves Lansdown.

Traders also focused on Nvidia's forecast that next quarter's revenue will be about $32.5 billion.

Though this was better than the average of analyst predictions, it left some observers disappointed that the days of triple-digit growth were over.

Investors were also laser focused on any potential delays to Nvidia’s new generation Blackwell line of technology, the successor to the best-selling Hopper line of AI chips that thrust the company onto the world stage.

CEO Huang said the new product line would ship at scale to clients in the coming months, with its previous generation of AI chips expected to maintain very strong sales.

Y.Parker--ThChM