CMSC

0.0084

The world's largest wireless technology showcase kicked off on Monday, with excitement over AI's potential to transform gadgets clashing with concerns over trade tensions fuelled by the United States.

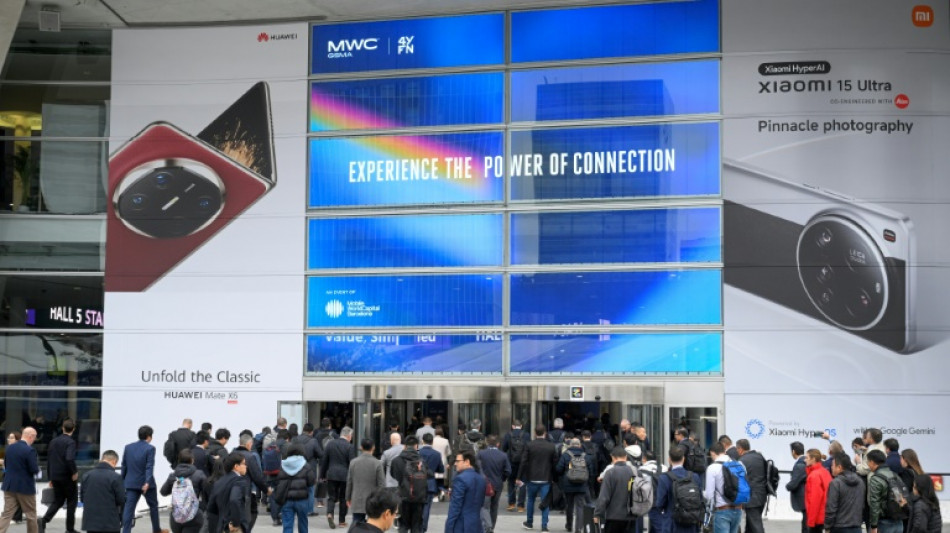

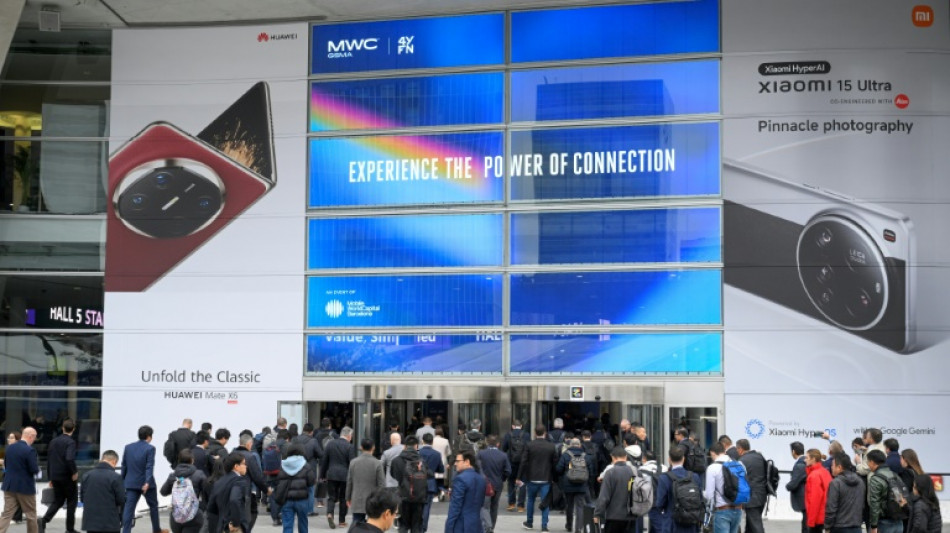

The annual Mobile World Congress (MWC) is set to draw around 100,000 attendees in Barcelona, the day before fresh American tariffs come into force on Chinese goods.

A dense crowd packed the halls between stands blazing with screens from early Monday morning, hunting out the latest devices and innovations from manufacturers or set to participate in debates about the future of the industry.

Many exhibitors at the MWC hail from China, whose products will be hit by an additional 10-percent import tariff on top of the 10 percent already imposed by President Donald Trump since he took office in January.

The billionaire president is also pushing neighbours Mexico and Canada to follow suit.

"Obviously a global tariff war would not be to anyone's benefit," although "nobody really knows what's going to happen" on trade, said Pekka Lundmark, CEO of major network hardware maker Nokia, at a pre-MWC event late Sunday.

Higher costs for trade could impact the entire global tech and smartphone market if Trump keeps the China tariffs in place and extends them to other major economies like the European Union, as he has threatened.

China is home to major tech companies such as Huawei, but it also assembles smartphones and other products sold by foreign firms such as Apple and produces key components.

Renate Nikolay, the European Commission's deputy director-general for communications networks, told AFP that the "challenging geopolitical context" means "it's crucial for Europe to ensure our tech sovereignty and our strategic autonomy in critical sectors".

But with no clear answers on trade, many participants will "try to forget" the issue for now to focus on the promise of AI, predicted Cedric Foray, telecoms chief at consultancy EY.

- AI, AI everywhere -

On Sunday, some of the many Chinese smartphone makers attending MWC alongside other global telecom heavyweights focused their pre-show announcements on new products and investments.

Manufacturer Honor -- a Huawei spinoff -- said it was launching a new phase in its development that would transform it into "a global leading AI device ecosystem company".

Honor said its future "intelligent" smartphones, developed with US firms Google Cloud and Qualcomm, would come equipped with AI "agents" that could take on tasks like scheduling events or reserving a table at a restaurant.

Competitor Xiaomi, the world's third-biggest smartphone maker after Apple and Samsung, unveiled a new range of smartphones equipped with high-quality cameras and their own suite of AI features.

Generative AI's capture of tech industry attention since ChatGPT first emerged has made it a must-have for any firm developing new devices.

There is "growing AI fatigue" among industry watchers as "it is often hard to understand the tangible benefits" for people actually using devices, said Ben Wood, analyst at tech research firm CCS Insight.

But EY's Foray said he expected "a big difference this year in that AI will be very concrete" in its applications.

"Agent" services like those shown off by Honor aim to show consumers how AI can boost their smartphones' capabilities.

Such hurdles have not kept a lid on smartphone sales, which recovered from two years of shrinkage to expand 6.3 percent in 2024 -- topping 1.2 billion units, according to market intelligence firm IDC.

Manufacturers are optimistic about maintaining the momentum into this year.

"The strong growth witnessed in 2024 proves the resilience of the smartphone market," IDC research director Nabila Popal said.

Sales growth had defied "lingering macro challenges, forex concerns in emerging markets, ongoing inflation, and lukewarm demand", she underlined.

D.Pan--ThChM