SCS

0.0800

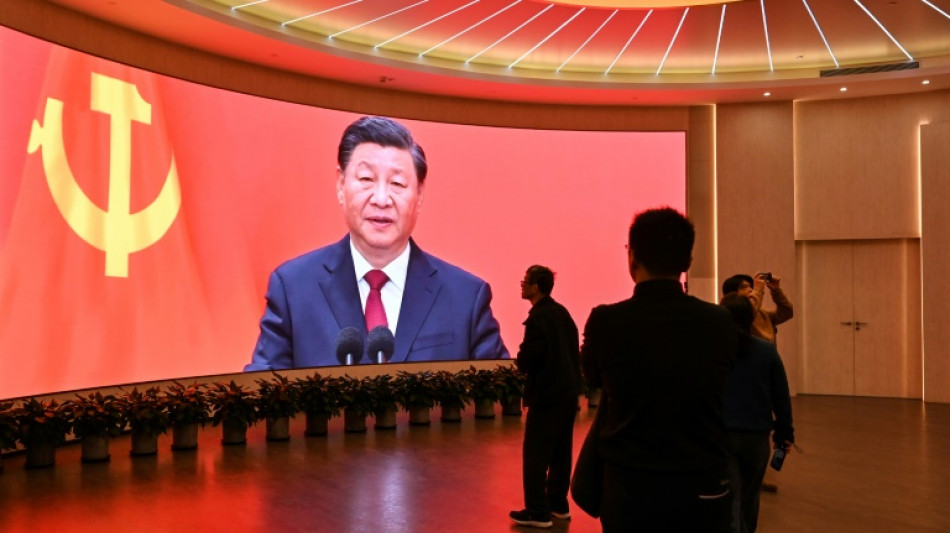

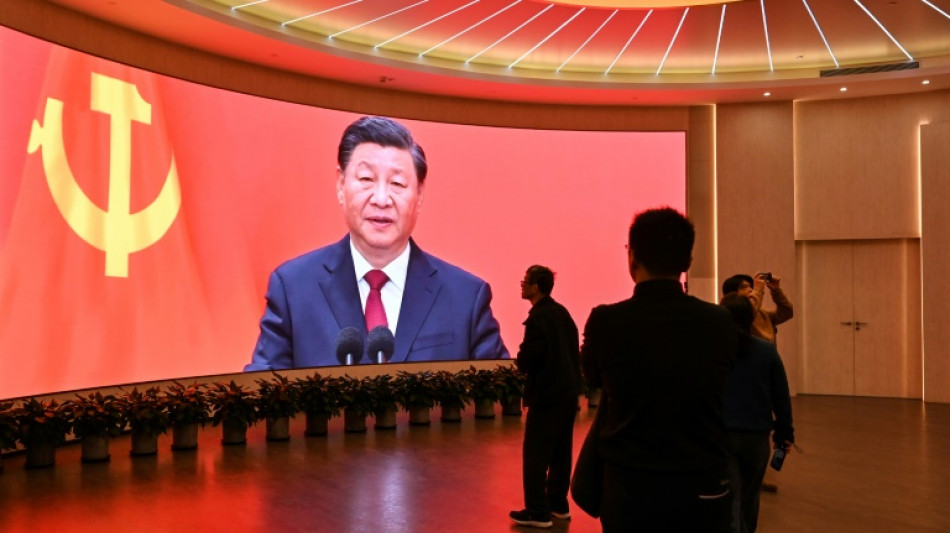

China's leadership convenes next week for closed-door meetings to hammer out plans to shield the ailing economy from tariffs and trade threats from US President Donald Trump.

The "Two Sessions" gatherings of the country's parliament and top advisory body are primarily talking shops, rubber-stamping decisions made by the Communist Party while giving a veneer of openness and accountability.

But they do offer a rare glimpse into the leadership's priorities and concerns while facing an unpredictable United States -- China's largest trading partner and strategic rival.

All eyes will be on Wednesday's opening of the National People's Congress (NPC) parliament, where Premier Li Qiang will lay out economic growth goals for 2025, offering insights into just how optimistic Beijing is about the year ahead, as well as new military spending.

Analysts polled by AFP broadly agreed that Beijing will set a goal of around five percent growth -- the same as 2024.

Many see that as an ambitious objective given the headwinds China is battling, and Beijing's continued reluctance to inject the economy with the kind of large-scale stimulus observers say it needs.

"From the faltering property market to weak household spending, elevated youth unemployment and tariffs, the economy is having a tough time," Harry Murphy Cruise, head of China and Australia economics at Moody's Analytics, told AFP.

"Any one of those challenges would be a headache for officials; combined, they are a migraine."

- More unpredictable -

Likely top of the agenda is Trump, who in just over a month back in the White House has overturned the international order and proven even more unpredictable than in his first term.

The US president imposed additional 10 percent duties on products imported from China last month and has threatened more.

The move could affect hundreds of billions of dollars in trade and may worsen if the magnate follows through on his threats of even higher customs levies.

A US-led push to squeeze China out of international supply chains for high-tech chips and other sensitive technology -- spearheaded by Joe Biden's administration -- is also expected to ramp up.

That effort has driven Beijing's policy of technological self-reliance, part of a broader initiative by China's leadership to develop "new quality productive forces" that it hopes can boost growth.

Last May, Beijing poured more than $47 billion into the country's largest-ever chip investment fund -- the third phase of an effort that outpaced the first two phases combined.

"Beijing is betting that a massive party-led push for research, innovation, commercialisation, manufacturing and digitalisation can create new economic growth drivers," analysts Neil Thomas and Jing Qian at the Asia Society said in a note.

China hopes it can "replace the real estate sector and generate productivity gains that help mitigate issues related to debt, demographics and dependence on the West", they added.

Analysts also said pressure from Trump could encourage Beijing to step up the kinds of support for the economy seen last year -- interest rate cuts, easing local government debt pressure and expanding subsidy programmes for household goods.

"We expect China to increase policy support in response to greater external shock from the US," Wang Tao, chief China economist at UBS, told AFP.

And more "will be rolled out later in the year... should there be additional significant tariffs or other external shocks, or should the property downturn turn worse", she added.

- Property crisis -

Another key issue is weak domestic consumption.

Demand has been a long-running drag on the world's second-largest economy, fuelling a deflationary spiral that has kept prices stubbornly low.

Analysts expect policymakers to broaden the scope of a consumer goods trade-in programme initiated last year that allows shoppers to exchange older home appliances and other items.

That, said Louise Loo of Oxford Economics, "could have an immediate, albeit temporary, impact on retail spending".

But they warn much deeper issues are driving a crisis of confidence in the economy, which long enjoyed double-digit growth but has languished since the pandemic.

The continued crisis in China's vast property sector -- once a key driver of growth but now beset with sprawling debt -- has become emblematic of that malaise.

Last month, new home prices in China's most developed "first-tier" cities fell 3.4 percent year-on-year, according to the National Bureau of Statistics.

The slide was even more pronounced in second-tier cities, where new home prices dropped five percent on-year in January, and in third-tier cities where prices fell six percent, the data showed.

"Our prognosis of China's problems continues to lie in housing," Oxford Economics' Loo said, pointing to the impact the crisis was having on everything from local government finances to consumer demand.

"Overcoming these powerful negative feedback loops in the economy this year would be policymakers' key task."

U.Chen--ThChM