SCS

0.0200

Nvidia became the first company to touch $4 trillion in market value on Wednesday, a new milestone in Wall Street's bet that artificial intelligence will transform the economy.

Shortly after the stock market opened, Nvidia vaulted as high as $164.42, giving it a valuation above $4 trillion. The stock subsequently edged lower, ending just under the record threshold.

"The market has an incredible certainty that AI is the future," said Steve Sosnick of Interactive Brokers. "Nvidia is certainly the company most positioned to benefit from that gold rush."

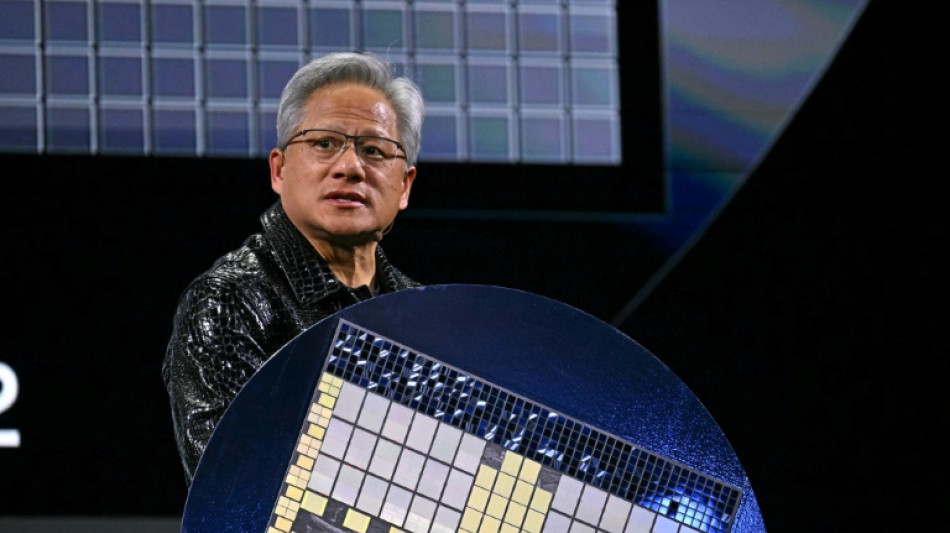

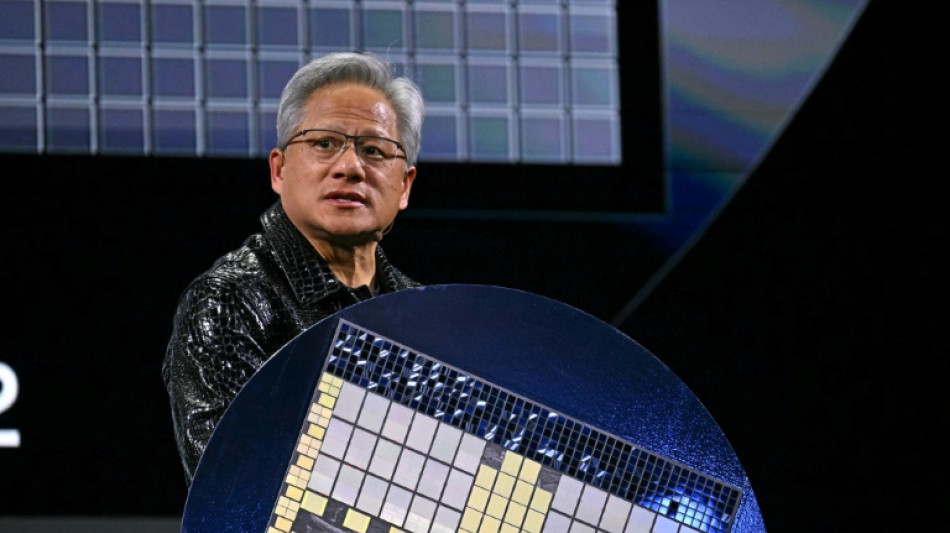

Nvidia, led by electrical engineer Jensen Huang, now has a market value greater than the GDP of France, Britain or India, a testament to investor confidence that AI will spur a new era of robotics and automation.

The California chip company's latest surge is helping drive a recovery in the broader stock market, as Nvidia itself outperforms major indices.

Part of this is due to relief that President Donald Trump has walked back his most draconian tariffs, which pummeled global markets in early April.

Even as Trump announced new tariff actions in recent days, US stocks have stayed at lofty levels, with the tech-centered Nasdaq ending at a fresh record on Wednesday.

"You've seen the markets walk us back from a worst-case scenario in terms of tariffs," said Angelo Zino, technology analyst at CFRA Research.

While Nvidia still faces US export controls to China as well as broader tariff uncertainty, the company's deal to build AI infrastructure in Saudi Arabia during a Trump state visit in May showed a potential upside in the US president's trade policy.

"We've seen the administration using Nvidia chips as a bargaining chip," Zino said.

- New advances -

Nvidia's surge to $4 trillion marks a new benchmark in a fairly consistent rise over the last two years as AI enthusiasm has built.

In 2025 so far, the company's shares have risen more than 21 percent, whereas the Nasdaq has gained 6.7 percent.

Taiwan-born Huang has wowed investors with a series of advances, including its core product: graphics processing units (GPUs), key to many of the generative AI programs behind autonomous driving, robotics and other cutting-edge domains.

The company has also unveiled its Blackwell next-generation technology allowing more super processing capacity. One of its advances is "real-time digital twins," significantly speeding production development time in manufacturing, aerospace and myriad other sectors.

However, Nvidia's winning streak was challenged early in 2025 when China-based DeepSeek shook up the world of generative AI with a low-cost, high-performance model that challenged the hegemony of OpenAI and other big-spending behemoths.

Nvidia's lost some $600 billion in market valuation in a single session during this period.

Huang has welcomed DeepSeek's presence, while arguing against US export constraints.

- AI race -

In the most recent quarter, Nvidia reported earnings of nearly $19 billion despite a $4.5 billion hit from US export controls limiting sales of cutting-edge technology to China.

The first-quarter earnings period also revealed that momentum for AI remained strong. Many of the biggest tech companies -- Microsoft, Google, Amazon and Meta -- are jostling to come out on top in the multi-billion-dollar AI race.

A recent UBS survey of technology executives showed Nvidia widening its lead over rivals.

Zino said Nvidia's latest surge reflected a fuller understanding of DeepSeek, which has ultimately stimulated investment in complex reasoning models but not threatened Nvidia's business.

Nvidia is at the forefront of "AI agents," the current focus in generative AI in which machines are able to reason and infer more than in the past, he said.

"Overall the demand landscape has improved for 2026 for these more complex reasoning models," Zino said.

But the speedy growth of AI will also be a source of disruption.

Executives at Ford, JPMorgan Chase and Amazon are among those who have begun to say the "quiet part out loud," according to a Wall Street Journal report recounting recent public acknowledgment of white-collar job loss due to AI.

Shares of Nvidia closed the day at $162.88, up 1.8 percent, finishing at just under $4 trillion in market value.

S.Davis--ThChM